Author: 4C Mortgage Consultancy | Category: Newsletter | Date: July 19, 2024

Products Highlights for July The interest rates for mortgages stand at a fixed rate of 3.98% for a 3-year. This stable rate is contributing to a favourable environment for individuals interested in purchasing residential properties, thus potentially encouraging home transactions. Connect with 4C Mortgage Consultancy certified mortgage brokers in Dubai and Abu Dhabi and let Read More...

Author: 4C Mortgage Consultancy | Category: Blogs | Date: June 15, 2024

Impact Of Credit Score on Mortgage Buying Enhancing the credit score prior to applying can greatly improve the mortgage opportunity and savings. Connect with 4C Mortgage Consultancy certified mortgage brokers in Dubai and Abu Dhabi and let them help you plan your investment in Dubai, UAE. 4C Mortgage Consultants provides the best mortgage consultancy for a resale Read More...

Author: 4C Mortgage Consultancy | Category: Blogs | Date: May 15, 2024

Enjoy reading our monthly updates and do not forget to subscribe to our newsletter. Excerpt from the newsletter Why Hire a Mortgage Consultant for your Real Estate Extensive knowledge of the local market and can provide valuable insights. Customized recommendations that fit specific financial goals. Access to multiple lenders which gives access to a broader Read More...

Author: 4C Mortgage Consultancy | Category: Blogs | Date: April 15, 2024

Enjoy reading our monthly updates and subscribe to our newsletter. Excerpt from the newsletter Quick Tips on How to Repay Mortgage Fast! Reduce the principle amount and save money on interest. Lower interest rates and reduce the term of the mortgage. Make extra payments per year and pay off the mortgage faster. Look in for Read More...

Author: 4C Mortgage Consultancy | Category: Blogs | Date: February 15, 2024

Refinancing Strategies in UAE Mortgage Market • Periodically review your financial situation and the mortgage market. • Explore the option of switching your mortgage to a different lender offering better terms • Work with your existing lender to restructure your loan. • If the value of your property has increased since you initially took out Read More...

Author: 4C Mortgage Consultancy | Category: Blogs | Date: January 12, 2024

A very Happy New Year to you all and enjoy this amazing updates on the mortgage market 5 mandatory Tips for improving credit score for better mortgage rates• Monitoring your credit report regularly helps you stay informed about your financial standing.• Late payments can have a negative impact on your credit score, so consistently pay Read More...

Author: 4C Mortgage Consultancy | Category: Blogs | Date: January 5, 2024

If you’re looking to buy property in Dubai, you may be wondering if it’s possible to get a loan to finance your purchase. The good news is that yes, it is possible to get a loan in Dubai to buy property. The real estate market in Dubai has seen a surge in the number of Read More...

Author: 4C Mortgage Consultancy | Category: Blogs | Date: December 5, 2023

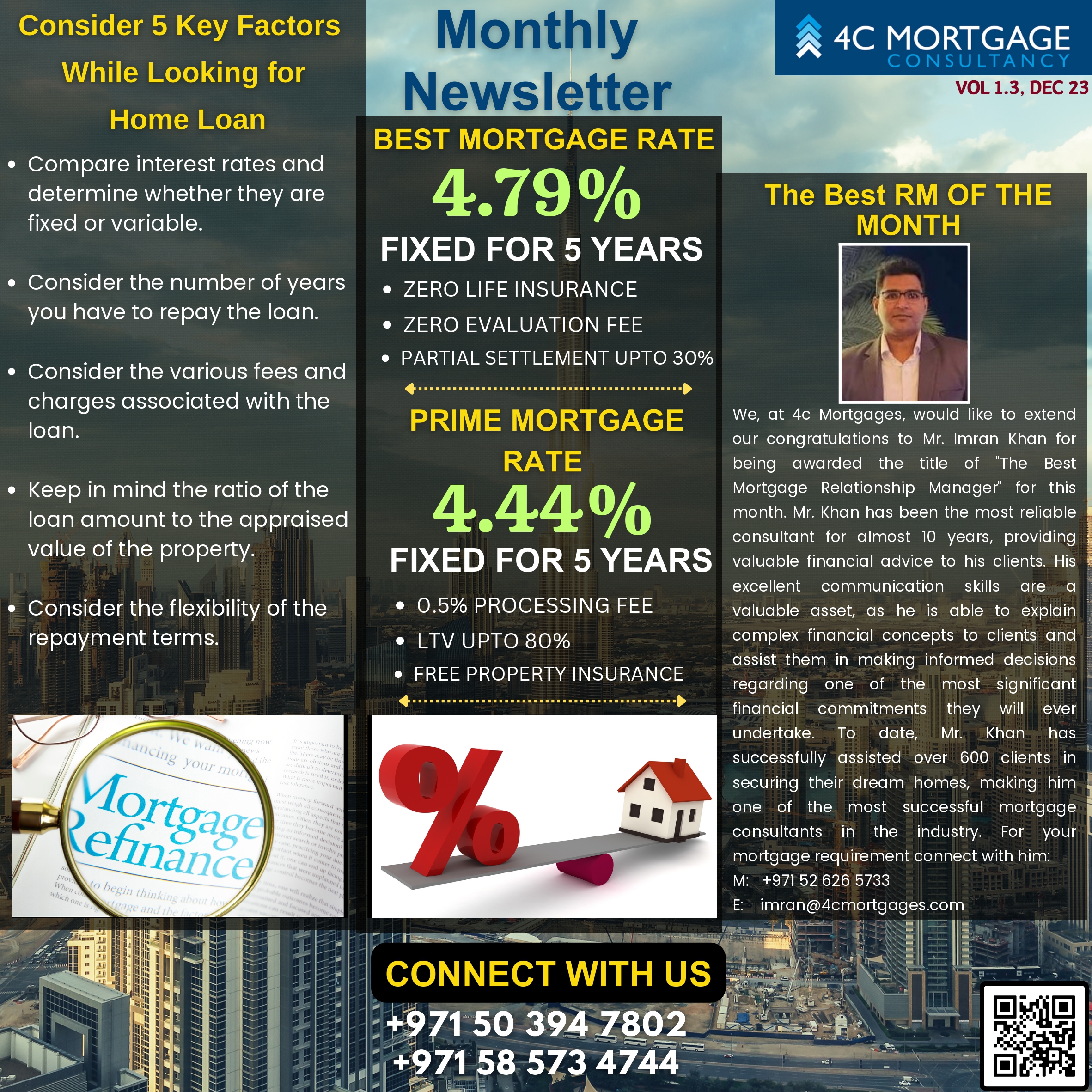

Enjoy reading our monthly updates and subscribe to our newsletter. Excerpt from the newsletter Consider 5 key factors while looking for mortgage in Dubai. Connect with 4C Mortgage Consultancy certified mortgage brokers in Dubai and Abu Dhabi and let them help you plan your investment in Dubai, UAE. 4C Mortgage Consultants provides the best Read More...

Author: 4C Mortgage Consultancy | Category: Blogs | Date: January 22, 2021

With Al Etihad Credit Bureau (AECB) in place, every mortgage lender looks at your credit report to check the current financial situation and borrowing history, which indicates them to work out how much they can lend, and whether they can trust you to pay it back. It also empowers to have superior pricing of loans, Read More...

Author: 4C Mortgage Consultancy | Category: Blogs | Date: June 28, 2018

I currently have two personal loans. I’m expecting to receive a large bonus by the year end.Should I use that towards repaying my loan or is it a better idea to invest it in a savings account? While I would say that getting rid of debt is always a prudent idea, sometimes it might Read More...