Author: 4C Mortgage Consultancy | Category: Newsletter | Date: July 19, 2024

Products Highlights for July The interest rates for mortgages stand at a fixed rate of 3.98% for a 3-year. This stable rate is contributing to a favourable environment for individuals interested in purchasing residential properties, thus potentially encouraging home transactions. Connect with 4C Mortgage Consultancy certified mortgage brokers in Dubai and Abu Dhabi and let Read More...

Author: 4C Mortgage Consultancy | Category: Blogs | Date: March 15, 2024

Tips for Non-UAE Resident to obtain Mortgage with UAE bank. – Consider working with a mortgage broker who can help you navigate the process and find the best deals. – Understand the eligibility criteria set by the UAE banks for non-residents to apply for a mortgage. – Check your credit score and ensure that it Read More...

Author: 4C Mortgage Consultancy | Category: Blogs | Date: January 12, 2024

A very Happy New Year to you all and enjoy this amazing updates on the mortgage market 5 mandatory Tips for improving credit score for better mortgage rates• Monitoring your credit report regularly helps you stay informed about your financial standing.• Late payments can have a negative impact on your credit score, so consistently pay Read More...

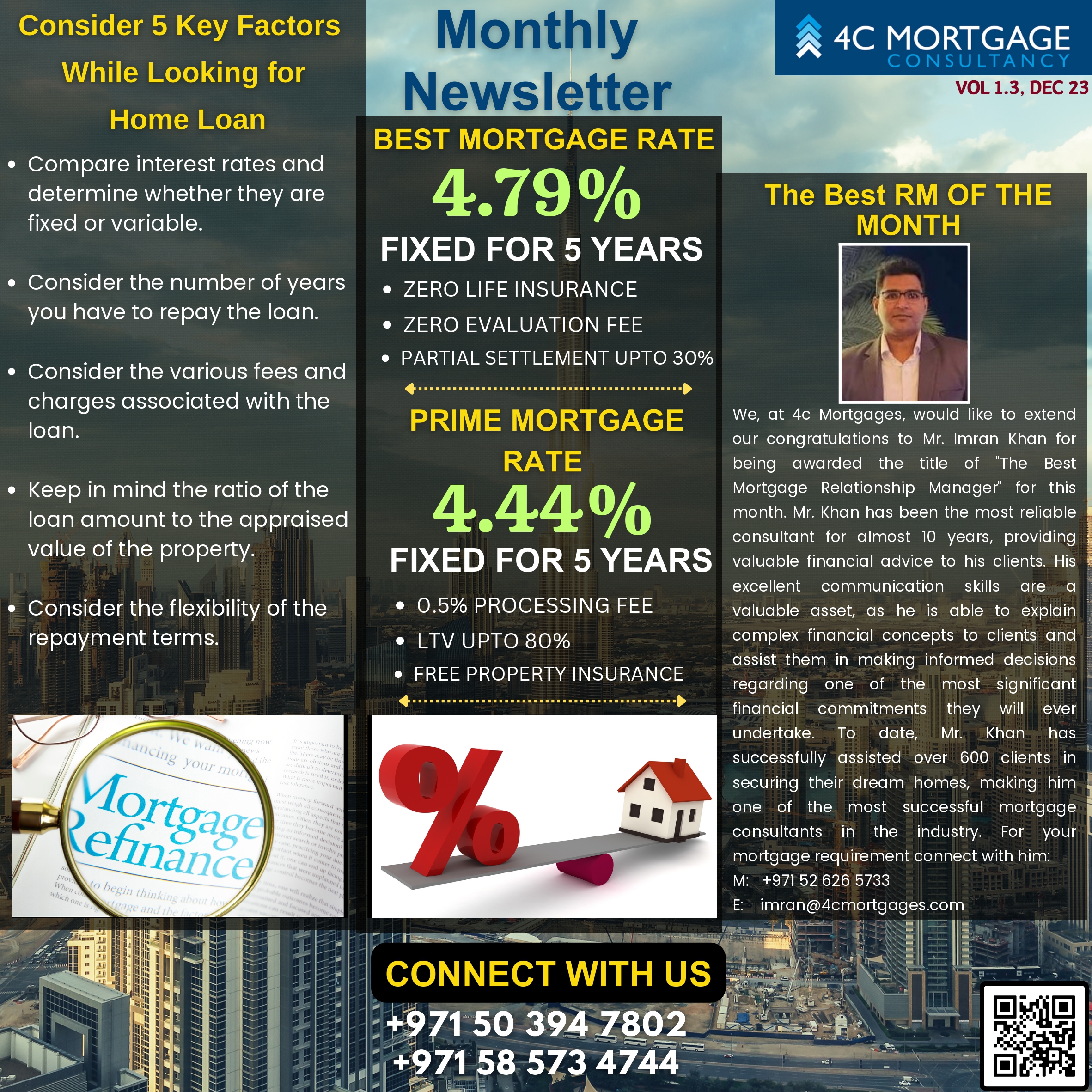

Author: 4C Mortgage Consultancy | Category: Blogs | Date: December 5, 2023

Enjoy reading our monthly updates and subscribe to our newsletter. Excerpt from the newsletter Consider 5 key factors while looking for mortgage in Dubai. Connect with 4C Mortgage Consultancy certified mortgage brokers in Dubai and Abu Dhabi and let them help you plan your investment in Dubai, UAE. 4C Mortgage Consultants provides the best Read More...

Author: 4C Mortgage Consultancy | Category: Uncategorized | Date: April 19, 2020

Can foreigners get mortgage in Dubai? Well, Yes mortgage in Dubai for foreign national is possible, but you should do your homework properly before you apply for one. Whether you have property in Dubai or you are looking for mortgage for buying property in Dubai or bought off-plan and need mortgage for final developer handover payment, Read More...

Author: 4C Mortgage Consultancy | Category: Blogs | Date: February 18, 2019

Timely intervention to infuse new funding for projects- When the UAE Central Bank removed a key hurdle that had long limited the ability of banks to fund real estate projects, it also made sure to remain flexible to counter risks of an overheating market. Announced in November, the regulation abolished a ceiling on banks’ Read More...

Author: 4C Mortgage Consultancy | Category: Blogs | Date: December 31, 2018

This new year, let’s have the resolution to have a secure grip on our finances. And let us adopt one new money habit today and drop the one that’s been holding us back. To protect the financial future, one needs to identify bad financial habits and understand the ways to avoid those inaccuracies on Read More...

Author: 4C Mortgage Consultancy | Category: Blogs | Date: October 31, 2018

How to start my investment with a small amount of AED 5000 a month. I want to target the short-term investment options which provide me a good return. Short-term investments are any assets that are projected to perish or to be honored within the progression of one to three years. The objective of Read More...

Author: 4C Mortgage Consultancy | Category: Blogs | Date: August 22, 2018

Buying your own property is always a better decision if one can afford, but does it make nous to buy a property now? Eye-catching payment plan, firsthand inventory and price tweak, indeed give homebuyers now a better choice in UAE’s property market. The UAE real estate is relatively an innovative marketplace and gives Read More...