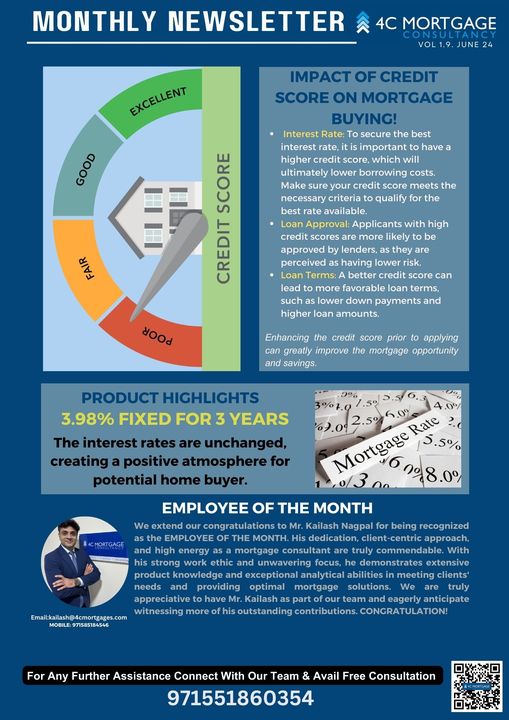

Impact Of Credit Score on Mortgage Buying

- Interest Rate: To secure the best interest rate, it is important to have a higher credit score, which will ultimately lower borrowing costs. Make sure your credit score meets the necessary criteria to qualify for the best rate available.

- Loan Approval: Applicants with high credit scores are more likely to be approved by lenders, as they are perceived as having lower risk.

- Loan Terms: A better credit score can lead to more favorable loan terms, such as lower down payments and higher loan amounts.

Enhancing the credit score prior to applying can greatly improve the mortgage opportunity and savings.

Connect with 4C Mortgage Consultancy certified mortgage brokers in Dubai and Abu Dhabi and let them help you plan your investment in Dubai, UAE. 4C Mortgage Consultants provides the best mortgage consultancy for a resale property, new purchase property, mortgage refinance, off-plan purchase, construction mortgage, project finance, commercial mortgage, buyout, equity release, and non-UAE resident mortgage in Dubai.

Follow us on Twitter, Facebook, and LinkedIn, and Instagram keep yourself updated with more home-buying tips.